The United States is one of the most popular destinations for foreign entrepreneurs to start their businesses. This is attributed to the country’s strong economy, stable political environment, and high-quality infrastructure. The US government has enacted laws and regulations that make it easy for foreign entrepreneurs to form companies in the country. However, starting and running a business in the US can be challenging for foreign entrepreneurs who are not familiar with the laws and regulations. In this blog post, we will discuss the business opportunities for foreign entrepreneurs to form companies in the United States.

1. Understanding the US Business Environment

Before forming a company in the US, foreign entrepreneurs must understand the country’s business environment. The business environment in the US is highly competitive, and companies that succeed are typically those that offer unique products or services. Foreign entrepreneurs must also understand the legal and regulatory environment that governs businesses in the US. These laws and regulations vary by state, and it is essential to consult with an attorney who specializes in business law to ensure compliance.

2. Types of Businesses that Foreign Entrepreneurs can Form in the US

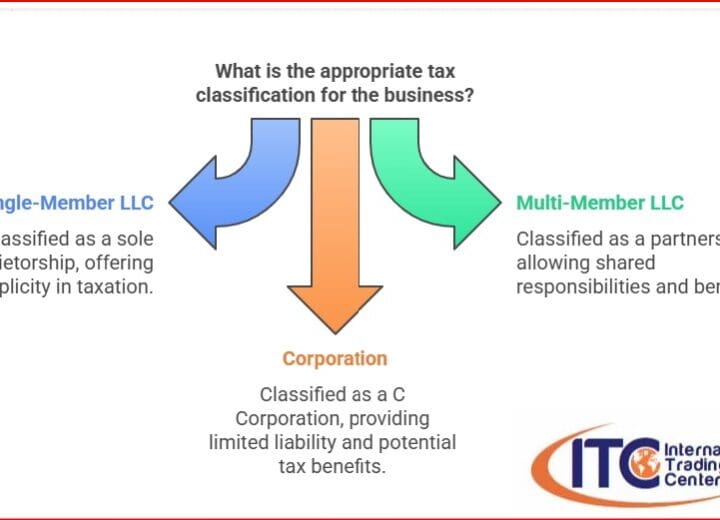

Foreign entrepreneurs can form various types of businesses in the US, including sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). Each type of business has its benefits and drawbacks, and foreign entrepreneurs must carefully consider their options before forming a company. Sole proprietorships and partnerships are relatively easy to form and operate, but they do not offer the same level of liability protection as corporations and LLCs.

3. Business Opportunities for Foreign Entrepreneurs in the US

Foreign entrepreneurs can find business opportunities in various sectors, including technology, healthcare, tourism, and education. The US is home to some of the world’s leading technology companies, and foreign entrepreneurs can leverage this to start their technology companies. The healthcare sector is also a lucrative market for foreign entrepreneurs, as the US has one of the largest healthcare markets globally. Additionally, foreign entrepreneurs can start tourist-related businesses in areas where there is a high demand for tourism services.

4. The Benefits of Forming a Company in the US

Opening a company in the US has several benefits for foreign entrepreneurs. The country has a stable political environment, a robust legal system, and a business-friendly environment that makes it easy to start a business. Additionally, the US has a vast market that provides opportunities for businesses to grow and expand. Foreign entrepreneurs who form companies in the US can also access funding from venture capitalists and other investors.

5. Challenges of Forming a Company in the US

Forming a company in the US also comes with some challenges, especially for foreign entrepreneurs. These challenges include navigating the complex legal and regulatory environment, obtaining the necessary licenses and permits, and finding the right business partners and suppliers. Additionally, foreign entrepreneurs may face cultural and language barriers when conducting business in the US.

International Trading Center (ITC) is a reliable and highly professional organization that can help you to overcome the challenges of opening a company in the US. The process of establishing a business in the US can be daunting, with numerous legal, financial, and administrative procedures to follow, as well as cultural and linguistic barriers to overcome. However, with the assistance of ITC, these challenges can be navigated with ease.

6. Legal and Regulatory Requirements for Foreign Entrepreneurs to Form Companies in the US

Foreign entrepreneurs who want to form companies in the US must comply with various legal and regulatory requirements. These requirements vary by state and may include obtaining the necessary licenses and permits, registering the company with the relevant authorities, and complying with tax laws. Foreign entrepreneurs must also be aware of the visa requirements that apply to them and their employees.

7. Funding Opportunities for Foreign Entrepreneurs in the US

Foreign entrepreneurs can access funding from various sources in the US, including venture capitalists, angel investors, and crowdfunding platforms. However, accessing funding may be challenging for foreign entrepreneurs who do not have a track record of success or who are not familiar with the US investment landscape. Foreign entrepreneurs must also be aware of the tax implications of receiving funding from these sources.

8. Hiring Employees in the US as a Foreign Entrepreneur

Foreign entrepreneurs who want to hire employees in the US must comply with several legal and regulatory requirements. These requirements include obtaining the necessary work visas, complying with labor laws, and providing employee benefits. Foreign entrepreneurs must also be aware of the cultural and language differences that may arise when hiring employees in the US.

Conclusion

Forming a company in the US presents significant opportunities for foreign entrepreneurs who want to start and grow their businesses. However, it also comes with its challenges, and foreign entrepreneurs must be prepared to navigate the complex legal and regulatory environment. With the right support and guidance, foreign entrepreneurs can succeed in forming companies in the US and access the vast market that the country provides.

If you are looking to start a business in the U.S., partnering with International Trading Center can help you overcome these challenges and ensure that your business will be successful in the long run. With our extensive range of services and expertise, we are the perfect partner for any company looking to gain a foothold in the US market.