Choosing the right legal structure is a critical decision for any entrepreneur looking to start a business in the USA. The legal structure impacts everything from daily operations and taxes to personal liability and regulatory requirements. In this guide, we’ll explore the various legal structures available for companies in the USA, helping you make an informed choice that aligns with your business goals and needs.

Sole Proprietorship

A sole proprietorship is easily established and gives the owner complete control of his business. If it performs activities comautomatically, it will be considered a sole proprietorship, but it is not registered as any other type of business, the sole proprietorship does not produce a separate business entity. This means that the company’s assets and liabilities are not separate from its personal assets and liabilities. He could be personally liable for the debts and obligations of the company. Owners of sole proprietorships can still obtain a trade name. It may also be difficult to get financing, as you cannot sell stock and banks are reluctant to lend to sole proprietorships.

The sole proprietorship can be a good option for low-risk businesses and owners who want to test a business idea before creating a more formal company.

Partnerships

Partnerships are the simplest structure for two or more people to have a business together. There are two common types of partnerships: the limited partnership (LP [limited partnerships]) and the limited liability partnership (LLP [limited liability partnerships]).

Limited partnerships have only one general partner (managing partner) with unlimited liability while all other partners have limited liability. Limited liability partners (limited partners) also tend to have limited control over the company, which is documented in the partnership agreement. Profits pass through personal tax returns and the general partner (the partner without limited liability) must also pay taxes as a self-employed person.

Limited liability companies are similar to limited partnerships, but give limited liability to all owners. An LLP protects each partner from debts incurred for the partnership.

In addition, the partners are not liable for the actions of the other partners. Partnerships can be a good option for businesses with several owners, for groups of professionals (such as lawyers) and groups that want to test a business idea before forming a more formal company.

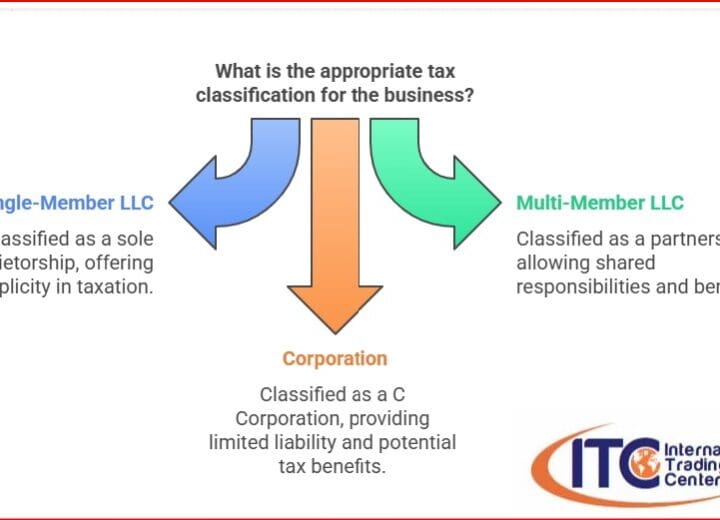

Limited Liability Company (LLC)

An LLC allows you to take advantage of the benefits of the corporate and partnership business structure. LLCs protect you from personal liability in most cases, i.e., your personal property (such as your vehicle, home and savings account) are not at risk in the event the LLC goes bankrupt or faces lawsuits. Profits and losses can be passed through your personal income without having to face corporate taxes. However, members of an LLC are considered self-employed and must pay self-employment tax contributions to Medicare and Social Security.

In many states, LLCs may have a limited duration. When a member joins or leaves the LLC, some states require that the company be dissolved and re-formed with the new members, unless it is already an agreement has been established within the same LLC to buy, sell and transfer the property. LLCs can be a good option for medium to high risk businesses, for owners with significant personal assets they wish to protect, and owners who want to pay a lower tax rate than a corporation.

Corporations

Corporation C

Corporations, also called C corporations, are a legal entity that is separate from its owners. Corporations can make profits, pay taxes and be legally liable. Corporations offer their owners protection against personal liability, but the cost of forming them is higher than other structures. Corporations also require comprehensive accounting, operational processes and reporting.

Unlike sole proprietorships, partnerships and LLCs, corporations pay taxes on their profits. In some cases, corporate profits are taxed twice: first, when the company earns profits, and then when dividends are paid to shareholders through their personal tax returns. Corporations have a life completely independent and separate from their shareholders. If a shareholder leaves the company or sells its shares, the C Corporation can continue to operate almost undisturbed.

Corporations have an advantage when it comes to raising capital, as they can raise funds by selling stock, which can also be a benefit in attracting employees. Corporations may be a good option for medium- to high-risk businesses that need to raise money and plan to go public” or be sold over time.

S Corporation

The S corporation (S corp) is a special type of corporation that is designed to avoid the drawback of double taxation in regular C corporations. It allows profits, and some losses, to pass directly through to the owner’s personal income without becoming subject to corporate tax rates. Not all states tax S corporations the same, but most recognize them as does the federal government and tax shareholders accordingly. Some states tax their profits above a specific threshold; others do not recognize the S corporation election at all and simply treat it as a C corporation. S corporations must file an application with the IRS to obtain S corporation status, which is a different process than registering with your state.

S corporations have special limits; they cannot have more than 100 shareholders and all must be U.S. citizens. In any case, you must follow the strict operational and filing processes of the C corporations.

S corporations also have an independent life, just like C corporations. If a shareholder leaves the company and sells his shares, the S corporation can continue to operate almost unchanged.

The S corporation may be a good option for businesses that would otherwise be C corporations, but meet the criteria to register as an S corporation.

Source: sba.gov – Small Business Administration