Florida is one of the largest states in the U.S., with fertile economic grounds for business opportunities. As a non-U.S. resident, conducting business in Florida requires a vast understanding of the state’s legal and regulatory framework. This guide aims to provide you with essential information on how to start and manage a business in Florida as a non-U.S. resident.

1. Business Structures in Florida

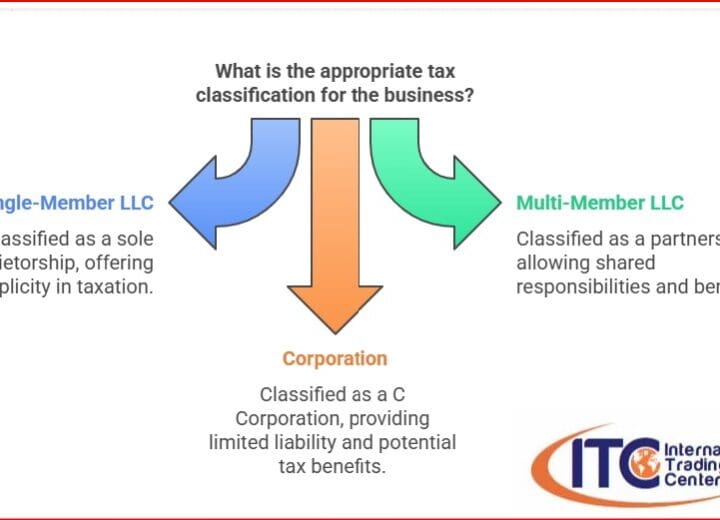

Before starting a business in Florida, you need to choose a suitable business structure. Under the U.S. laws, there are various business entities to choose from, including sole proprietorship, partnership, limited liability company (LLC), corporation, and nonprofit organization. LLCs are the most popular business structure among small businesses in Florida, primarily due to the owners’ limited liability.

The LLC structure shields the business owners from personal liability for the business’s debts and obligations. It also provides tax flexibility, with the option of being taxed as either a corporation or a partnership. Florida has straightforward procedures for forming all business structures, and you can complete the process within a few days.

International Trading Center (ITC) is a Miami-based registered agent and one of the main services offered is business planning assistance. This includes assistance in creating a business plan, identifying potential customers or clients, and determining the best location for business operations. ITC can also help non-U.S. residents obtain the necessary permits and licenses to operate a business in Florida.

2. Business Licenses and Permits

After choosing a business structure, the next step is to obtain and comply with the necessary licenses and permits. Florida has various licenses and permits depending on the business type and nature, and the requirements may differ among counties or cities.

Some businesses, such as food establishments or construction firms, require specific licenses and certifications. You can obtain the licenses and permits from the State of Florida or the local authorities in your county or city. Non-compliance with the licensing requirements can attract hefty fines or business closure.

3. Tax Obligations

As a non-U.S. resident conducting business in Florida, you are subject to various federal, state, and local taxes, depending on the business structure and location. It’s advisable to consult a tax professional for advice on the tax obligations before starting the business.

Florida does not impose state income tax, but the state has a sales tax of 6%. Additionally, businesses operating in the state are subject to corporate income tax at a rate of 5.5%, depending on the revenue and location. Florida also has property and unemployment taxes, among others.

4. Employment Law

If you plan to hire employees in Florida, you need to comply with the federal and state labor laws. The laws cover various aspects, including minimum wage, overtime, discrimination, and working hours.

Florida has a minimum wage rate of $8.56 per hour, higher than the federal minimum wage rate of $7.25 per hour. However, some businesses, such as small companies with fewer than four employees, are exempt from the minimum wage requirement. Violation of the employment laws can result in litigation and fines.

5. Intellectual Property Protection

When conducting business in Florida, you need to protect your business’s intellectual property rights to prevent infringement by competitors. Intellectual property includes trademarks, patents, copyrights, and trade secrets.

Florida’s intellectual property laws are in line with the federal laws, and you can apply for registration and protection with the U.S. Patent and Trademark Office. You can also enforce your intellectual property rights through litigation in Florida courts.

6. Banking and Financing

Non-U.S. residents can open business bank accounts in Florida but need to comply with the federal and state laws. The bank account allows you to separate personal and business finances, as well as facilitate transactions with clients and suppliers.

Additionally, you can finance the business through various means, including loans, grants, or crowdfunding. The Florida Small Business Administration (SBA) provides loans and resources for small businesses to access financing.

7. Real Estate Considerations

Florida’s real estate market is one of the most robust in the U.S., with various opportunities for commercial and residential properties. As a non-U.S. resident, you can also invest in real estate and conduct business from the premises.

Before acquiring a property in Florida, you need to comply with the zoning and land-use laws, obtain the necessary permits and licenses, and conduct due diligence on the property’s title and condition. You can also consult a real estate agent or attorney for advice on the legal and financial implications of the investment.

8. Marketing and Customer Acquisition

Marketing and customer acquisition are essential for the success of any business, and Florida offers a vast market for various products and services. You can reach potential customers through various marketing channels, such as social media, paid advertising, or events.

To succeed in the Florida market, you need to understand the target audience’s preferences and behavior, and tailor your marketing strategy accordingly. Also, provide unique value propositions and create lasting relationships with customers to build a loyal customer base.

Conclusion

Doing business in Florida as a non-U.S. resident requires sufficient knowledge of the legal and regulatory framework, tax obligations, and market dynamics. You need to comply with the licensing and permit requirements, choose a suitable business structure, protect your intellectual property, and comply with the labor laws.

Additionally, access financing and investment opportunities, and establish effective marketing strategies to reach the target audience and build a loyal customer base. With the right approach, Florida provides a fertile ground for business opportunities and growth.

International Trading Center is an invaluable resource for non-U.S. residents looking to do business in Florida. With our comprehensive range of services and experienced team of professionals, ITC can provide entrepreneurs and business owners with the support they need to succeed in the competitive U.S. marketplace.