Starting a business can often feel like piecing together a complex puzzle, but the journey begins with one crucial step: registration. As of 2024, the United States is home to approximately 33.2 million businesses, ranging from small retail shops to large corporations. For aspiring entrepreneurs eager to join this vibrant market, careful planning is essential.

Each year, millions of businesses are launched, and for those looking to start their own, registration is the first significant hurdle to overcome. While the process may initially appear daunting, understanding the steps involved can significantly ease the burden.

This guide will walk you through each stage of business registration, simplifying the complex journey of starting your own venture. With this roadmap, you can navigate the process with confidence and make your business officially recognized.

Choosing Your Business Structure

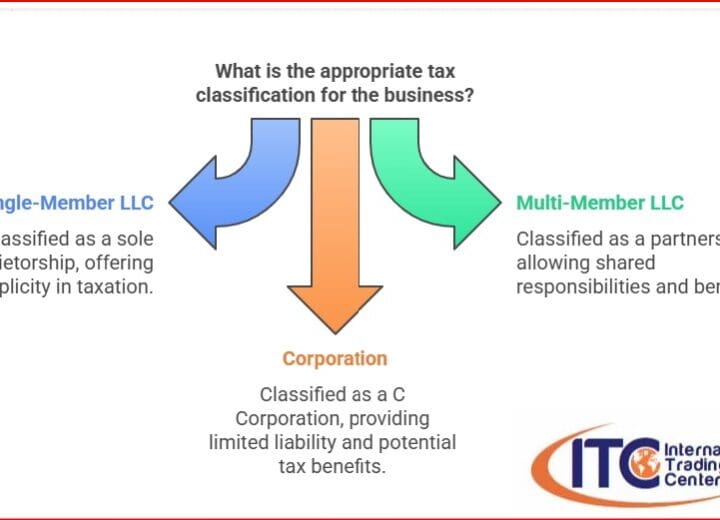

Choosing the right business structure is a significant decision that can have lasting implications for your venture. It affects your tax obligations, your ability to raise funds, and the amount of paperwork you’ll need to manage. In the United States, the primary business structures include sole proprietorships, partnerships, corporations, and limited liability companies (LLCs), each with its own advantages and disadvantages. Select wisely, as this decision will influence your business for years to come. If necessary, consult with a legal expert to fully understand the implications of each structure.

Understanding the various legal business structures can be complex, yet it is essential. Consider how involved you want to be in managing the business and how much personal liability you are willing to assume. For example, a sole proprietorship offers ease of control but makes you personally liable for business debts. On the other hand, a corporation provides limited liability protection but involves more compliance requirements. Additionally, each structure has different tax implications, which can directly impact your net income.

- Sole proprietorship

Sole proprietorships are the simplest form of business structure, allowing one person to operate the business. They are easy to start and maintain, but they expose personal assets to business liabilities. - Partnership

Partnerships share similarities, involving two or more individuals who jointly run the business; however, shared control can sometimes lead to conflicts. - Limited Liability Company (LLCs)

Limited liability companies (LLCs) strike a balance by offering flexibility and protection from personal liability, making them a popular choice for many small businesses. - Corporation

Corporations, while more complex, are advantageous if you aim to raise significant capital by selling stock. They offer personal liability protection but require adherence to more formal regulations and the establishment of a board of directors. This structure may be particularly beneficial if you plan for large-scale growth.

Remember that each state has its own regulations governing these business entities, so thorough research is crucial before making a final decision.

Registering Your Business Name

Registering your business name might sound simple, but it is a step that requires careful thought. Your business name is your brand in the market, and it must capture what your business stands for. Begin by choosing a name that is not already in use. Use the US Patent and Trademark Office’s database to check for availability. This step helps protect your identity and brand.

Apart from the trademark database, each state has its own registry. Check with your local Secretary of State’s office or website to confirm your business name isn’t taken. You might want to reserve your name even before registering to prevent others from snapping it up. Once confirmed, consider registering a domain name that matches your business name so your brand’s online presence is secure.

Your business name is more than just words; it’s your public identity. It should be easy to pronounce, remember, and spell. Avoid names that might limit your products or services as your business grows. It’s vital to think about how your name reflects your brand and your mission. Keep it simple yet memorable to attract and retain customers.

Getting Your Federal and State Tax IDs (EIN)

Obtaining federal and state tax IDs is crucial for tax purposes. The Federal Tax ID, known as the Employer Identification Number (EIN), is like a social security number for your business. You need it to hire employees, open bank accounts, and file taxes. Apply online through the IRS website—it’s free and straightforward.

State tax IDs are also mandatory for most businesses. These IDs are necessary for state-level taxes such as sales tax or unemployment insurance tax. Requirements and procedures differ from state to state, so check your local government’s website for the precise steps. Having these IDs in place ensures you’re compliant with all tax obligations.

Tax IDs are essential for running a legitimate business. Without them, you can’t lawfully operate or open a business bank account. They are also required for specific types of business permits and licenses. Applying for these IDs early in the business setup process can help avoid delays. Ensure you understand the types of taxes applicable to your business model and keep records meticulously to ease the filing process.

Understanding Licenses and Permits

Licenses and permits might be required depending on your industry and location. They’re essential for complying with federal, state, and local laws. Not having the right licenses or permits can result in penalties or worse—shutting down your business. Identify which ones you need before launching by consulting resources like the SBA.

Industries such as food service, agriculture, and healthcare have specific regulatory requirements. Licenses usually have to be renewed periodically, so mark renewal dates on your calendar. The type of permit or license you need can depend on the nature of your business activities and where you’re located, including zoning laws. Check with local authorities to ensure compliance.

The steps for identifying and applying for these licenses may vary somewhat by region, but the process is generally similar across the United States:

1. Identify Required Licenses

Start by researching the licenses needed for your business based on its industry and location. Common types include professional licenses, industry-specific licenses, and business activity permits.

2. Check the Issuing Agency

After identifying the required licenses, contact the relevant agency to confirm the specific requirements and application process. These details can differ by state, county, or city.

3. Gather Necessary Documentation

Depending on the license, you may need to provide various documents, such as proof of insurance, zoning approval, or educational qualifications.

4. Complete the Application

Once you have all the necessary documents, complete the application for the license. You can usually submit it online or by mail, depending on the agency.

5. Pay the Application Fee

Most licenses require a fee, which can vary based on the type of license and the issuing agency.

6. Wait for Approval

After submitting your application and fee, you’ll need to wait for approval. This process may take several weeks, so plan accordingly.

7. Display Your License

Once approved, you may need to display your license prominently at your business location if required by law.

Register with State Agencies

Once you have chosen a business structure, named your business, and obtained an Employer Identification Number (EIN), the next step is to register with state agencies. Requirements can vary based on your state and the type of business you operate. However, you will typically need to file paperwork and pay any associated fees.

Here’s what registering your business with state agencies usually involves:

- Register Your Business Entity

You will need to register your business entity with your state. This generally includes filing documents such as Articles of Incorporation, Articles of Organization, or Partnership Agreements, depending on your chosen business structure. - File for Taxes

Based on your business structure and location, you may need to register for federal, state, or local taxes. This can involve income tax, sales tax, and payroll tax. - Obtain Necessary Insurance

Depending on your industry and location, you might be required to get specific types of insurance, such as liability insurance or workers’ compensation insurance. - Comply with Additional State Requirements

Your business type and location may also require you to meet additional state obligations, such as registering for unemployment insurance or adhering to environmental regulations.

Set Up Accounting

Proper accounting is a backbone for any successful business strategy. Using accounting software simplifies tracking expenses, income, and preparing financial statements. Consider hiring an accountant or a bookkeeper if your operations are large or complex. They can provide insights into financial health and ensure tax compliance.

A basic understanding of accounting can go a long way in managing your business finances. Knowing how to interpret financial statements like balance sheets, income statements, and cash flow statements is vital. Invest in accounting software that suits your business type and budget. This tool will help avoid common financial pitfalls that often derail new businesses.

Regularly updating your books fosters transparency and identifies areas for cost-saving. You can spot cash flow issues before they become critical. It’s recommended to review your finances monthly and at the end of each fiscal year. These practices ensure you make informed decisions and maintain a healthy financial lifecycle. Consider setting up a separate system for payroll to prevent errors and streamline operations.

Advertise and Market Your Business

Marketing is an essential piece of the business puzzle. Start with a solid marketing plan that identifies your target audience and tailors messages to resonate with them. Leverage social media platforms, as they are potent tools for reaching a large audience without allocating a massive budget.

Traditional advertising methods still hold value. Depending on your target demographic, local newspapers, radio ads, or flyers might be effective. The goal is to increase brand awareness and attract customers by differentiating your business from competitors. A mix of online and offline strategies often yields the best results, offering broad exposure.

Brand consistency is key in marketing, which means your messaging and visuals should be uniform across all platforms. Engage with your audience through interactive content like polls and surveys. This approach not only builds community but also provides valuable feedback about your products or services. Allocate a budget specifically for marketing activities to effectively manage expenditure.

Complying with Employment Laws

Employment laws ensure fair treatment of employees and a balanced work environment. Whether you’re hiring your first employee or building a team, understanding these laws is crucial. Key aspects include wages, working hours, and safe workplace conditions. Violating these can lead to severe penalties.

It’s essential to be aware of the federal and state employment laws applicable to your business. They govern various aspects like anti-discrimination, benefits, and termination practices. Consulting with an employment law expert or an HR professional can keep you informed about legal obligations and rights. Keeping your workplace compliant maintains a positive reputation.

Stay updated with changes in labor laws to ensure adherence. Consider offering training programs for your staff to help them understand workplace policies. A compliant workplace not only avoids legal troubles but also improves employee satisfaction and productivity, creating a better business environment overall. Regular audits or reviews of your employment practices are advisable to ensure ongoing compliance.

Open a Bank Account

A business bank account is a dedicated account used solely for business transactions. Here are some reasons why opening a business bank account is important and almost mandatory:

- Separation of Finances

A business bank account allows you to keep your personal and business finances separate. This helps you track your business income and expenses more accurately, making tax reporting simpler. - Legal Protection

Having a separate business bank account can protect your personal assets in the event of legal issues or bankruptcy. It demonstrates that your business is a distinct legal entity, helping to shield your personal finances from business liabilities. - Establishing Credibility

A business bank account enhances your business’s credibility and professionalism. It shows that you are serious about your venture and committed to maintaining accurate financial records. - Easier Payment Acceptance

Even if you use a merchant account to accept customer payments, you will still need to transfer those funds into a business bank account. For instance, if you use Stripe to process payments, you are required to have a business bank account to receive those funds.

When selecting a bank, shop around and compare fees and services. Look for features that meet your needs, such as online banking, mobile banking, or overdraft protection. You might also consider choosing a bank that specializes in small business banking.

How CreateABusinessInUSA.com by International Trading Center – ITC can help?

CreateABusinessInUSA.com by International Trading Center (ITC) offers valuable resources and support for entrepreneurs looking to start and grow their businesses. Here’s how it can help:

- Guidance on Business Formation: ITC provides step-by-step guidance on how to register and establish a business, including information on necessary permits and legal requirements specific to various industries and locations.

- Access to Consulting and Resources: ITC also offers consulting programs and resources that cover essential topics such as business planning, marketing strategies, and financial management. This advice can be crucial for new entrepreneurs.

- Networking Opportunities: Users can connect with other entrepreneurs and business professionals through the ITC platform. Networking can lead to partnerships, collaborations, and new opportunities.

- Market Research and Insights: ITC provides access to market research and analysis tools that help entrepreneurs understand their target markets and industry trends, allowing them to make informed business decisions.

- Support with International Trade: For businesses interested in exporting or importing goods, ITC offers resources and expertise in international trade regulations, market entry strategies, and logistics.

- Business Tools: ITC provides various tools to help entrepreneurs with business plans, financial projections, and other essential documents needed for running a successful business.

By utilizing the resources available on CreateABusinessInUSA.com, entrepreneurs can enhance their knowledge, navigate the complexities of starting a business, and increase their chances of success in the marketplace.

Building Your Business Team

A successful business often hinges on a strong team. When hiring, focus on finding individuals whose skills complement each other and align with your company’s goals. Craft detailed job descriptions and conduct thorough interviews to select the best candidates. A robust onboarding process helps integrate new hires efficiently.

Rewarding top performers and offering growth opportunities can enhance team loyalty. Clearly articulate your company’s mission and values, fostering a culture that attracts like-minded people. Resist the urge to micromanage; trust your team’s expertise and encourage them to take ownership of their roles. This trust can boost their performance and job satisfaction.

Investing in employee development through training and workshops can significantly improve productivity. Keeping lines of communication open is vital. Whether through regular meetings or open-door policies, ensure employees feel heard and valued. A collaborative and positive work environment can be a significant competitive advantage.

Navigating the world of business registration might seem complex, but with the right guidance, it’s entirely achievable. Follow these steps and set a strong foundation for success.

Start Your Company in USA Today!

In summary, starting and operating a business involves several key steps, including obtaining necessary permits and licenses, registering with state agencies, and opening a dedicated business bank account. Each step is crucial for ensuring legal compliance, protecting personal assets, and establishing a professional image. Resources like CreateABusinessInUSA.com by International Trading Center can further support entrepreneurs by providing guidance on business formation, training, networking opportunities, market insights, and access to funding. Taking advantage of these tools and knowledge can significantly enhance an entrepreneur’s chances of success in today’s competitive marketplace.