Tax Basics for Entrepreneurs

Tax issues are relatively complex in the USA and generally require the help of an accountant to file federal taxes with the IRS.

But it is important that the members of the company have clarity at least on the basics.

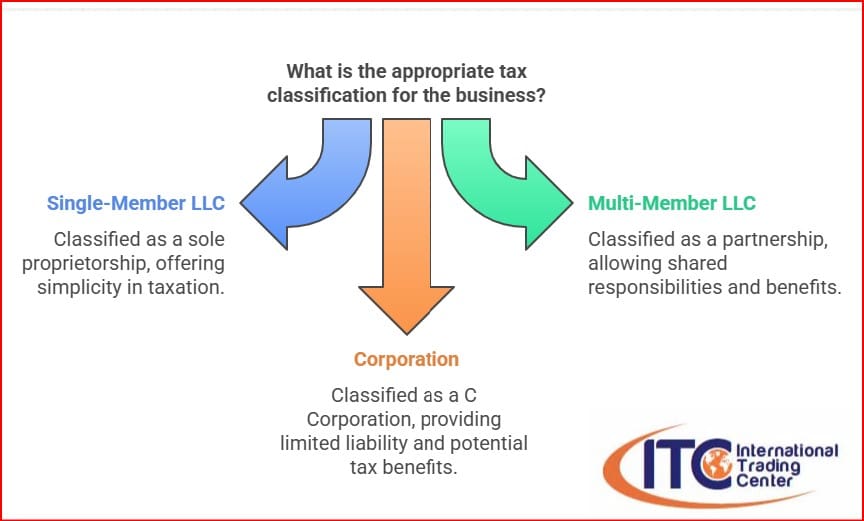

The first thing we must emphasize is that the type of company that one creates is not necessarily the one that defines how taxes are presented. The IRS allows businesses to select in various ways how they want to file, and that is why it is important to be clear about this concept.

To begin the process with the IRS – Form SS-4 is required to apply for an EIN. The EIN (Employee Identification Number) is a 9-digit number assigned to the business (corporations, LLCs, partnerships, estates, trusts, and other entities) in order to have a unique identification number to file taxes with the IRS (Internal Revenue Service). The EIN, in practice, is also called the company’s TAX ID, Tax Number, or Taxpayer Identification Number.

On Form SS-4, we must identify the type of business we created that is applying for the EIN.

The options that foreigners have are to create a Corporation or an LLC (Limited Liability Company). For the LLC, it must be indicated whether it is a single member or a multi-member LLC.

The SS-4 can be sent in different ways to the IRS and depending on the form the process can take 4 to 6 weeks on average. You will receive a letter with the assigned number and the assigned tax classification. If the classification is correct, you don’t have to do anything else until taxes are filed.

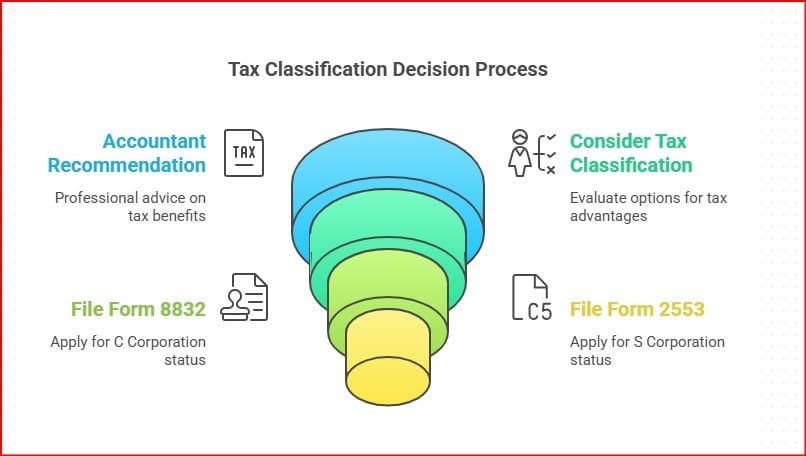

If the classification is not ideal, according to the recommendation of your accountant, you must fill out a new form to make the change.

Form 8832

One of the forms used for the change of status is 8832. Not everyone who fills out Form SS-4 (Application for an Employer Identification Number) needs to file Form 8832 (Election of Entity Classification). Only if they need to change their default tax classification.

Here are the most common IRS default classifications:

- A single-member LLC is classified as a sole proprietorship.

- A multi-member LLC is classified as a partnership.

- A Corporation is classified as a C Corporation.

Once the EIN and the pre-classification has been received, with the recommendation of the Accountant, it can be decided if it is preferable to change and classify the company differently because it offers tax advantages, or because its characteristics require it.

Then there’s this option:

An LLC, single-member or multi-member, that wishes to be taxed as a Corporation, must file Form 8832 to become a C Corporation.

Form 2553

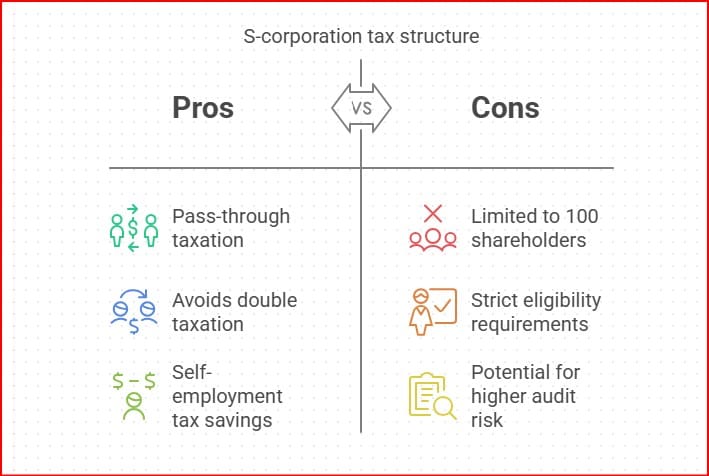

LLCs and Corporations can also benefit from the change to an S Corporation, using Form 2553.

Note: Companies with foreign members cannot apply to the S-Corporation. There are other limitations that need to be considered.

The S Corporation has another series of tax advantages that the accountant can explain to you, and that includes:

Pass-Through Taxation: Gains and losses are passed on to shareholders, avoiding corporate income tax.

Avoids double taxation: Unlike C-corps, S-corps do not pay corporate taxes on profits. Instead, income is taxed only at the shareholder level.

Self-employment tax savings : Shareholders can receive dividends (distributions) instead of wages, which reduces Social Security and Medicare taxes.

These changes should preferably occur within 75 days of receiving the EIN. Existing companies that wish to make the change can also do so before March 15 of the respective year.