The United States of America has a highly developed and diversified economy, making it a hub for international trade and investment. Foreign investors are attracted to the US market for several reasons, including a favorable business environment, access to global markets, and vibrant entrepreneurial culture. However, before foreign investors can set up shop in the US, they must navigate the complex legal and regulatory framework governing company registration. This article provides a comprehensive guide on company registration in the United States for foreign investors.

1. Understanding the US Legal System

The United States has a complex legal system that is divided into federal and state laws. Federal laws are created by the US Congress and apply to the entire country, while state laws are created by state legislatures and only apply within that state’s borders. Many aspects of company registration, such as taxation and labor laws, are governed by state laws.

Foreign investors must also be aware of the US Constitution, which provides the framework for all US laws. The Constitution outlines the powers and limitations of the federal government and guarantees certain rights to citizens and non-citizens alike.

2. Types of Business Entities

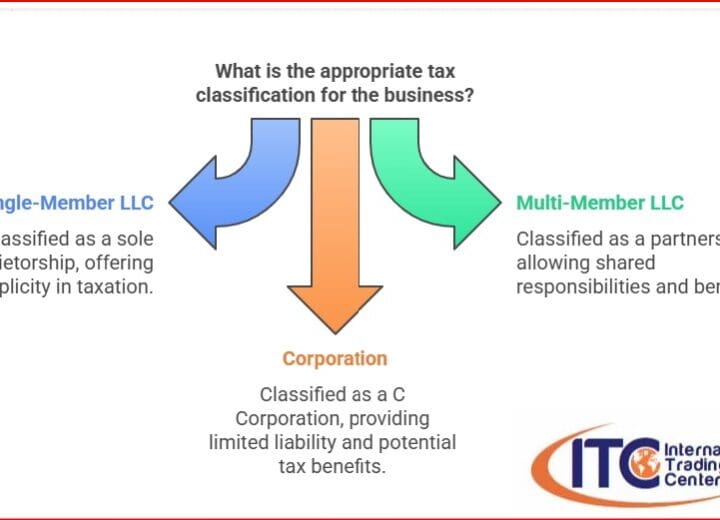

The US legal system recognizes several types of business entities, including limited liability companies (LLCs), corporations, partnerships, and sole proprietorships. Each type of entity has its own advantages and disadvantages, depending on the investor’s goals and objectives.

LLCs are the most popular type of business entity for foreign investors due to their flexibility, tax benefits, and limited liability protection. LLCs do not have to pay federal income tax as a separate entity, instead, the profits and losses are passed on to the owners (known as members) who pay individual income tax on their share of the profits.

3. Choosing a State

Once an investor has decided on the type of entity they want to form, they must choose which state to register in. Each state has its own laws and regulations governing the formation and operation of businesses. Some states are more business-friendly than others and offer tax incentives and other benefits to new businesses.

Delaware is often considered the most business-friendly state due to its flexible corporate laws, specialized courts for business disputes, and low taxes. However, other states such as Nevada, Wyoming, Florida and South Dakota are also popular for their business-friendly laws and regulations.

4. Obtaining an Employer Identification Number (EIN)

Every business in the US is required to have an employer identification number (EIN), which is a unique nine-digit number used to identify the business for tax purposes. Foreign investors can obtain an EIN from the Internal Revenue Service (IRS) by filing Form SS-4.

5. Registering the Business with the State

To register a business in the US, foreign investors must file the necessary paperwork with the state where the business will be located. The specific requirements vary by state, but generally, investors must file Articles of Organization or Articles of Incorporation with the Secretary of State’s office.

6. Registering for State Taxes

Most states require businesses to register for state taxes, such as sales tax and income tax, before conducting business in the state. Foreign investors must be aware of the tax laws in the state where their business is registered and ensure they are in compliance with all requirements.

7. Obtaining Business Licenses and Permits

In addition to registering with the state and obtaining an EIN, businesses may need to obtain additional licenses and permits to operate legally. The specific requirements vary by industry and location, but generally, businesses must obtain licenses and permits for activities such as selling alcohol, operating a restaurant, or providing professional services.

8. Hiring Employees

Foreign investors who plan to hire employees in the US must comply with federal and state employment laws. The US Department of Labor enforces laws such as minimum wage, overtime, and anti-discrimination laws. Investors must also obtain the appropriate visas for any foreign employees they plan to hire.

ITC is Here to Help

Registering a business in the United States can be a complex and time-consuming process, but it is essential for foreign investors who want to take advantage of the many opportunities offered by the US market. By understanding the legal and regulatory framework and following the necessary steps, investors can set up a successful business in the US and enjoy the benefits of operating in one of the world’s largest and most dynamic economies.

ITC – International Trading Center – provides foreign investors with assistance in company registration in the United States. We provide professional advice and assistance throughout the registration process, ensuring that all legal requirements are met. This can be helpful for those who want to start a business in the US but may not be familiar with the process and regulations.