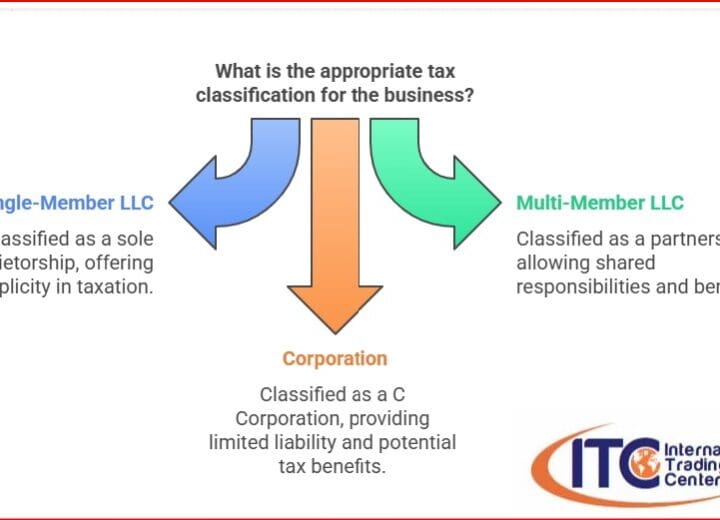

Federal Taxes

Ensure company compliance with U.S. federal tax regulations and optimize your corporate tax strategy.

State Taxes

Navigate state-specific tax laws for your business and reduce liabilities with tailored solutions.

Personal Taxes

Maximize your personal tax return with expert planning and precise filing services.

ACCOUNTING SERVICES

ITC's Comprehensive Accounting & Tax Solutions

We offer our clients professional accounting services in collaboration with experienced and renowned accountants.

Federal Income Tax: Getting Started

Expert assistance to get started with federal income tax filing, ensuring accurate returns and full compliance for individuals and businesses.

ITIN Forms: Processing and Renewal Fee

Efficient processing and renewal service per person, ensuring timely compliance and seamless tax identification management.

State Income Tax: Getting Started

Simplified guidance to get started with state income tax filing, ensuring compliance and accurate returns for individuals and businesses.

BOI Report

The bipartisan Corporate Transparency Act mandates U.S. businesses to report ownership details via a BOI report, aiming to curb illicit finance.

Explore BOI Report 1099 Forms: Annual Process

Expert management of annual 1099 forms, ensuring accurate reporting and compliance with streamlined processes for hassle-free tax season preparation.